Introduction

A credit score is a numerical representation of an individual’s creditworthiness and plays a crucial role in personal finance. This score, typically ranging from 300 to 850, is derived from an individual’s credit history and reflects their ability to repay debts. Lenders, financial institutions, and even landlords often utilize credit scores to assess the risk involved in extending credit or leasing property, making it an essential component of financial decision-making.

Understanding how to check your credit score for free without hurting it is vital for anyone wishing to manage their financial health effectively. Access to one’s credit score empowers individuals to make informed decisions regarding loans, credit cards, and other financial products. With regular monitoring, individuals can catch discrepancies or fraudulent activities early, allowing them to take corrective actions before these issues escalate and impact their financial future.

In the digital age, there are an abundance of free tools and resources available for checking credit scores. Several reputable services provide credit scores at no cost, ensuring users can keep an eye on their financial standing without incurring penalties or affecting their credit ratings. These tools emphasize convenience and security, offering a user-friendly experience for individuals of all backgrounds. Additionally, many of these services provide insights and educational content on managing credit, thus enhancing overall financial literacy.

As we delve deeper into the mechanisms of checking credit scores, it is essential to understand that being proactive about financial management can lead to improved outcomes, from securing favorable loan terms to better managing existing debts. By knowing how to check your credit score for free without hurting it, you take a vital step towards achieving your financial goals and ensuring a secure financial future.

Why You Should Check Your Credit Score Regularly

Monitoring your credit score on a regular basis is crucial for maintaining financial health and security. A credit score is a numerical representation of your creditworthiness, which lenders, employers, and even insurers may evaluate before making decisions. By routinely checking your credit score, you can stay informed about your credit health, allowing you to identify and address potential problems before they escalate.

One of the primary benefits of keeping an eye on your credit score is the opportunity to spot inaccuracies or fraudulent activities. Errors in your credit report can occur due to clerical mistakes or identity theft, and these inaccuracies can significantly harm your score. By checking your credit score for free, you can ensure that all the information is correct, helping to protect your financial future.

A good credit score is a valuable asset that can lead to better loan approvals and lower interest rates. Lenders are more likely to offer favorable terms to individuals with higher credit scores, which translates into significant savings over time, especially for large purchases such as homes or vehicles. Higher credit scores can also enhance your bargaining power when negotiating loan terms.

Moreover, your credit score plays a role beyond financial transactions; it can influence non-financial scenarios, like employment opportunities. Many employers conduct credit checks during the hiring process, especially for positions that require financial responsibility. A healthy credit score can therefore enhance your employability and open doors to new career prospects.

Importantly, checking your credit score does not negatively impact it, as inquiries you make yourself are categorized as “soft inquiries.” Therefore, understanding how to check your credit score for free without hurting it should be part of your regular financial routine. This practice not only fosters awareness but also enables proactive management of your financial health.

Step-by-Step Guide to Checking Your Credit Score for Free

Checking your credit score for free can be a straightforward process if you follow the right steps. A variety of reliable services, such as Credit Karma and Credit Sesame, can provide you with your credit score at no cost. These credit monitoring apps not only offer your credit score but also provide tools and resources to help you manage your credit effectively.

To start, download one of these apps or visit their websites. Sign up for an account, which typically requires you to provide some personal information, such as your name, address, and social security number. Once you’ve created your account, you will have immediate access to your credit score along with insights into your credit activity.

Another option to check your credit score for free is through your bank or credit card provider. Many financial institutions now offer complimentary access to credit scores as a part of their services. Simply log into your online banking account and look for the credit score feature, which is often available in the dashboard area.

Additionally, it is crucial to understand the distinction between a credit score and a credit report. A credit score is a three-digit number reflecting your creditworthiness, while a credit report is a comprehensive document outlining your credit history. To obtain your free credit report annually, you can visit AnnualCreditReport.com. This is the only website authorized by federal law to provide free yearly credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion.

When accessing these reports and scores, always ensure you are using secure websites or applications to protect your personal information. By following these steps, you can effectively learn how to check your credit score for free without hurting it, allowing you to take control of your financial health.

Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness, calculated based on information in your credit report. Typically ranging from 300 to 850, it serves as a critical indicator for lenders when making decisions about loan approvals and interest rates. Credit scores are categorized into ranges: poor (300-579), fair (580-669), good (670-739), and excellent (740 and above). Understanding where your score falls within these categories is essential to gauge your financial health.

Several key components influence your credit score, significantly impacting how lenders perceive you. The most critical factor is payment history, which accounts for approximately 35% of your score. Making payments on time demonstrates reliability. The second significant component is credit utilization, which constitutes about 30% of your score. This metric assesses how much of your available credit you’re using, with lower utilization typically being viewed more favorably. Lastly, the age of your credit accounts contributes roughly 15% to the score; a longer credit history can positively influence your standing.

For individuals who have a low credit score, there are actionable steps they can take to improve their standing. These include consistently making timely payments, reducing existing debt, and avoiding applying for new credit too frequently. Regularly checking your score and credit report is crucial; this is where understanding how to check your credit score for free without hurting it becomes invaluable. If discrepancies arise in your credit report, it’s important to address them promptly by contacting credit bureaus to dispute inaccuracies.

Common Mistakes to Avoid When Checking Your Credit Score

When individuals set out to check their credit score for free, they often encounter several pitfalls that can undermine their efforts. One of the most prevalent mistakes is opting for paid credit score services instead of utilizing the multitude of free resources available. Many reputable financial institutions provide free access to credit scores as part of their services. Opting for paid services can not only be an unnecessary expense but also lead people to believe they are getting a unique advantage when, in reality, they are missing out on adequate free alternatives.

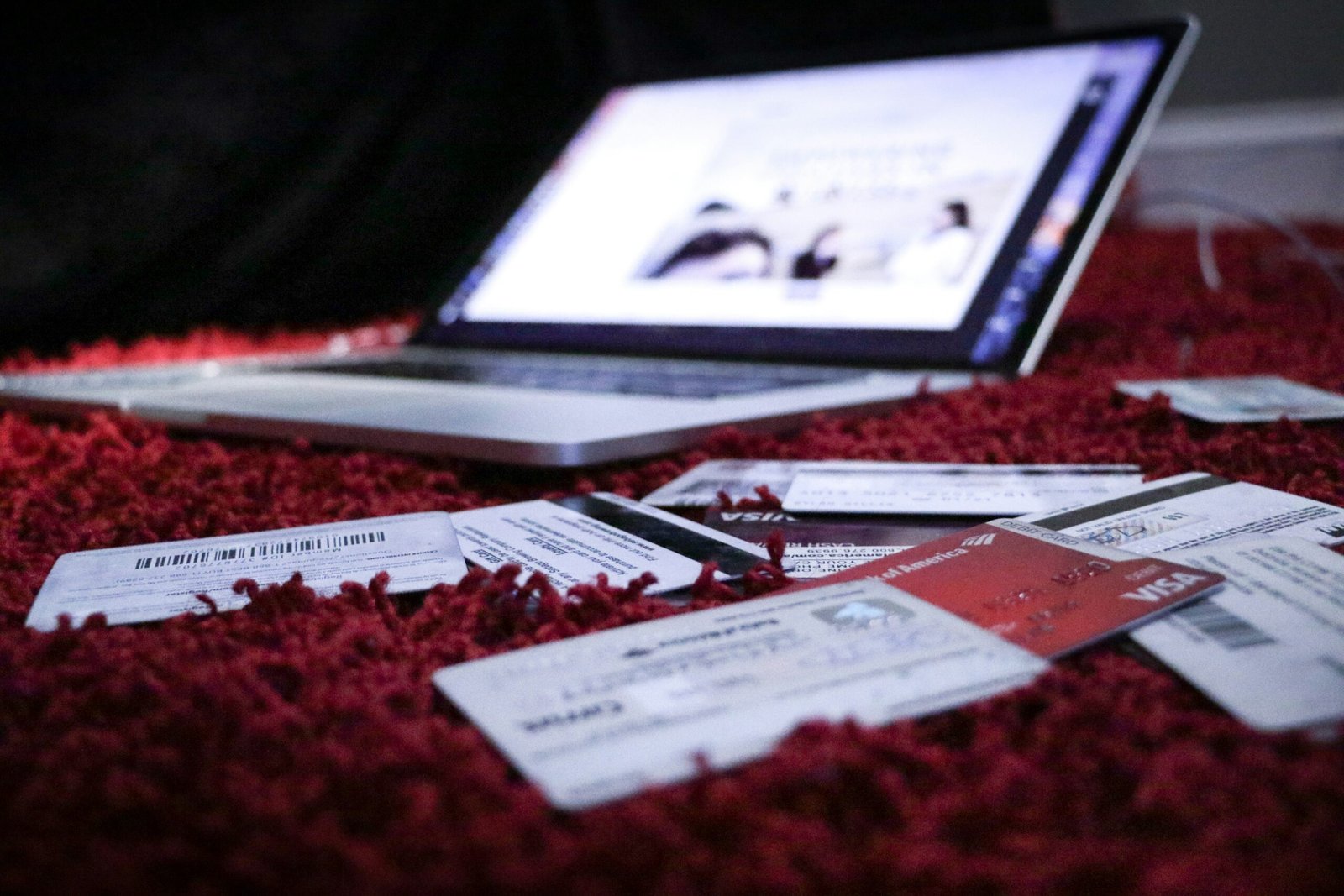

Another significant concern arises from the security of personal information. Many users fall prey to suspicious websites that request sensitive data like social security numbers or banking information. Engaging with these sites can lead to identity theft or fraud. It is crucial to verify that the site you are using to check your credit score is legitimate. Always look for well-known credit bureaus or trusted banks that offer free credit score access.

Moreover, individuals frequently overlook the difference between soft and hard inquiries when checking their credit scores. A common mistake is that users may inadvertently authorize a hard inquiry by using certain services or lenders. Unlike soft inquiries, which do not impact your credit score, hard inquiries can cause a temporary drop in your score. This makes it essential to understand how to check your credit score for free without incurring hard inquiries. Avoiding scenarios that lead to hard inquiries will protect your credit health. Remember, maintaining a healthy credit score is vital for achieving better financial opportunities.

Tips for Maintaining a Good Credit Score

Maintaining a good credit score is essential for securing favorable loan terms and interest rates, as well as for establishing a solid financial reputation. There are several actionable strategies that can help individuals effectively manage their credit scores over time. One of the most critical factors is timely bill payments. Late payments can negatively impact your score, making it crucial to set reminders for bills or consider automated payment options. Consistently paying bills on time demonstrates financial responsibility and helps maintain a positive credit history.

Another significant aspect of credit score management is keeping credit utilization ratios low. Credit utilization refers to the amount of credit you are using relative to your total available credit. Financial experts typically recommend keeping this ratio below 30%. To achieve this, individuals can pay down existing debts, avoid excessive use of credit cards, and request increases in credit limits if necessary. This strategy not only improves the credit score but also reflects positively on one’s overall financial health.

Regularly monitoring your credit report is equally important in maintaining a good credit score. It is advisable to review your reports at least once a year, as this allows you to identify any inaccuracies or fraudulent activity that may affect your score. If errors are found, promptly disputing them with the credit bureau can lead to corrections that improve your credit standing. Moreover, understanding how to check your credit score for free without hurting it is vital for ongoing awareness of your financial status.

By consistently applying these strategies—timely payments, low credit utilization, and regular monitoring—individuals can secure and enhance their financial standing. These practices empower borrowers to manage their credit responsibly and achieve their long-term financial goals.

Disclaimer

This blog post is intended solely for informational purposes and should not be construed as financial or legal advice. The content herein aims to provide a general understanding of the subject matter and guide readers on how to check your credit score for free without hurting it. However, it is crucial to recognize that individual circumstances may vary significantly. The strategies or methods discussed may not be suitable for everyone.

As credit scores play a crucial role in an individual’s financial health, engaging in practices that affect creditworthiness should be approached with caution. There are various ways to access one’s credit score, and while many options exist for checking these scores free of charge, readers are encouraged to evaluate the suitability of these methods for their personal situation. Conducting thorough research and understanding credit reports can lead to more empowered financial decisions.

For personalized guidance tailored to unique financial situations, it is highly advisable to consult certified financial advisors or credit counselors. These professionals can provide insights and advice specific to individual credit profiles, helping to navigate complex financial landscapes effectively. Relying on expert opinions can add considerable value and assurance to the process of managing one’s credit health.

In light of the information provided in this blog post, readers should always approach their credit scores with care and consider consulting with professionals before making consequential decisions linked to their financial futures. While learning how to monitor credit scores is essential, understanding the implications and seeking qualified advice on managing credit responsibly is just as crucial for long-term financial success.

Conclusion

Understanding your credit score and how to check it for free without hurting it is vital for maintaining financial health. Throughout this guide, we have discussed the numerous benefits of being aware of your credit score, such as enabling better decision-making when applying for loans or credit cards. A higher credit score often leads to lower interest rates and better financial offers, which could save you significant amounts of money over time.

Moreover, we explored various methods to access your credit score at no cost. Regularly monitoring your credit gives you insight into your financial standing and allows you to catch any discrepancies or errors that may arise. This proactive approach is crucial, as inaccuracies in your credit report can negatively affect your score. Several reputable services provide access to your credit score without any fees, ensuring that you have the necessary tools to stay informed.

Taking charge of your credit health empowers you to make wiser financial choices. We encourage you to utilize the resources discussed in this guide on how to check your credit score for free without hurting it, and stay engaged in managing your financial well-being. If you have experiences or tips of your own, we invite you to share them in the comments section below. Feel free to share this post with friends, family, or colleagues who may also benefit from learning about maintaining and managing their credit health. Being informed and proactive is key to fostering a sound financial future.